Welcome to

Hair's Portfolio

Domain Expertise

"Knowledge has to be improved, challenged, and increased constantly, or it vanishes" - Peter Drucker

ML Projects

Data Science - Machine Learning

QuantGold Dashboard

Advanced Canadian ETF Portfolio Management Dashboard incorporating daily static snapshots, Monte Carlo simulation, interactive macro indicators, quantitative risk and portfolio management.

FinReportRAG

An AI-native financial analytics system engineered with a modular microservices approach, integrating FastAPI for high-throughput API orchestration, LangChain for dynamic LLM-driven reasoning, OpenAI's transformer-based models for contextual comprehension, and a high-dimensional vector database for optimized semantic retrieval, as well as agentic AI.

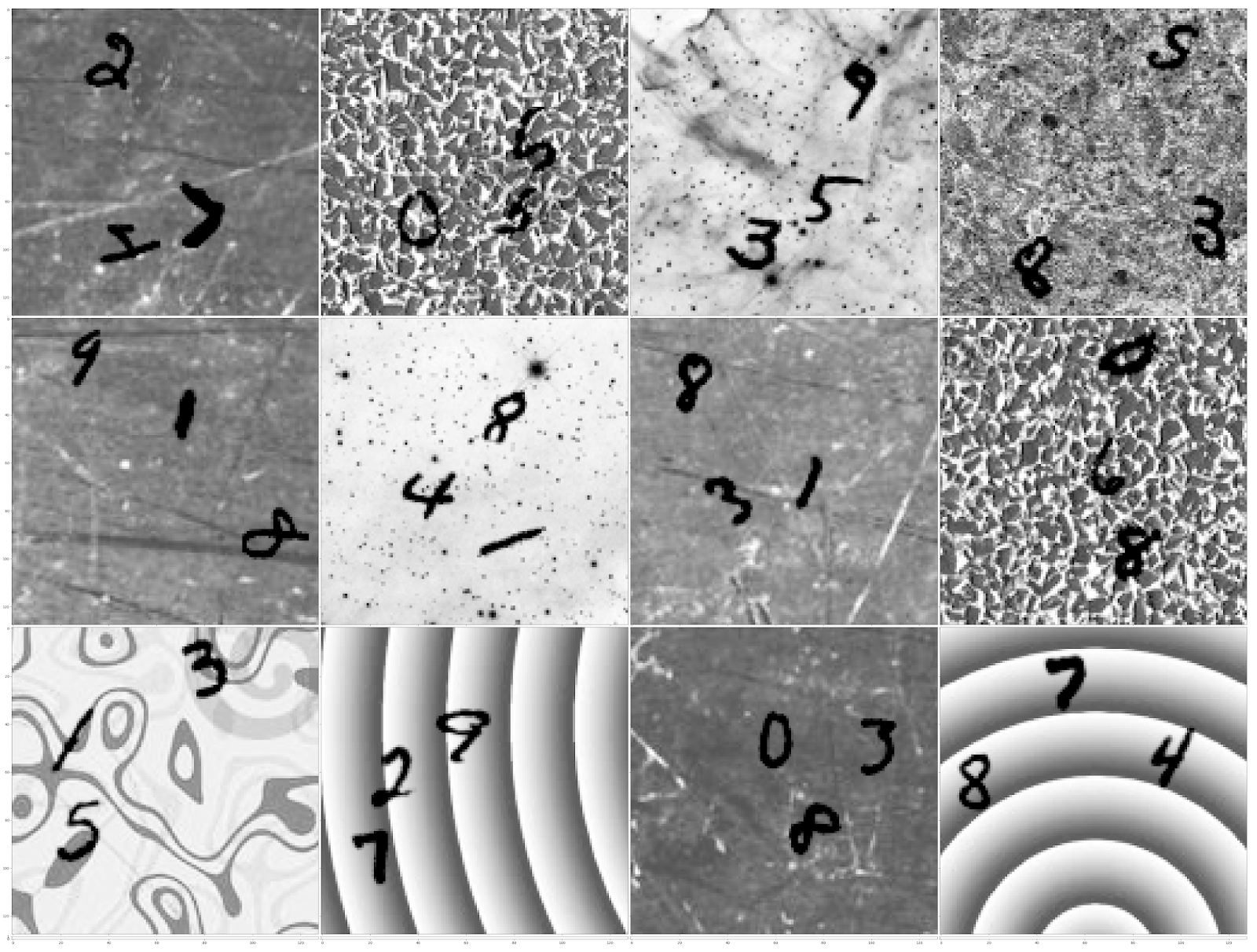

Multi-class Image Classification

Multi-class image classification challenge on the modified MNIST dataset, in which each example image contains three different digits. The challenge is to correctly classify them by identifying the highest digit.

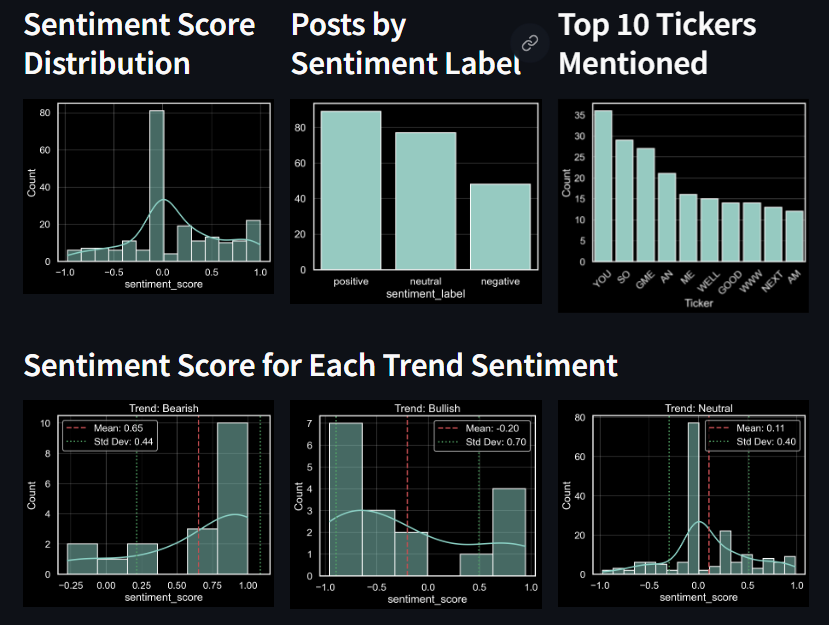

WallstreetbetsGenNLP

An AI-powered, multi-model behavioral analysis of Wallstreetbets investor discussions.

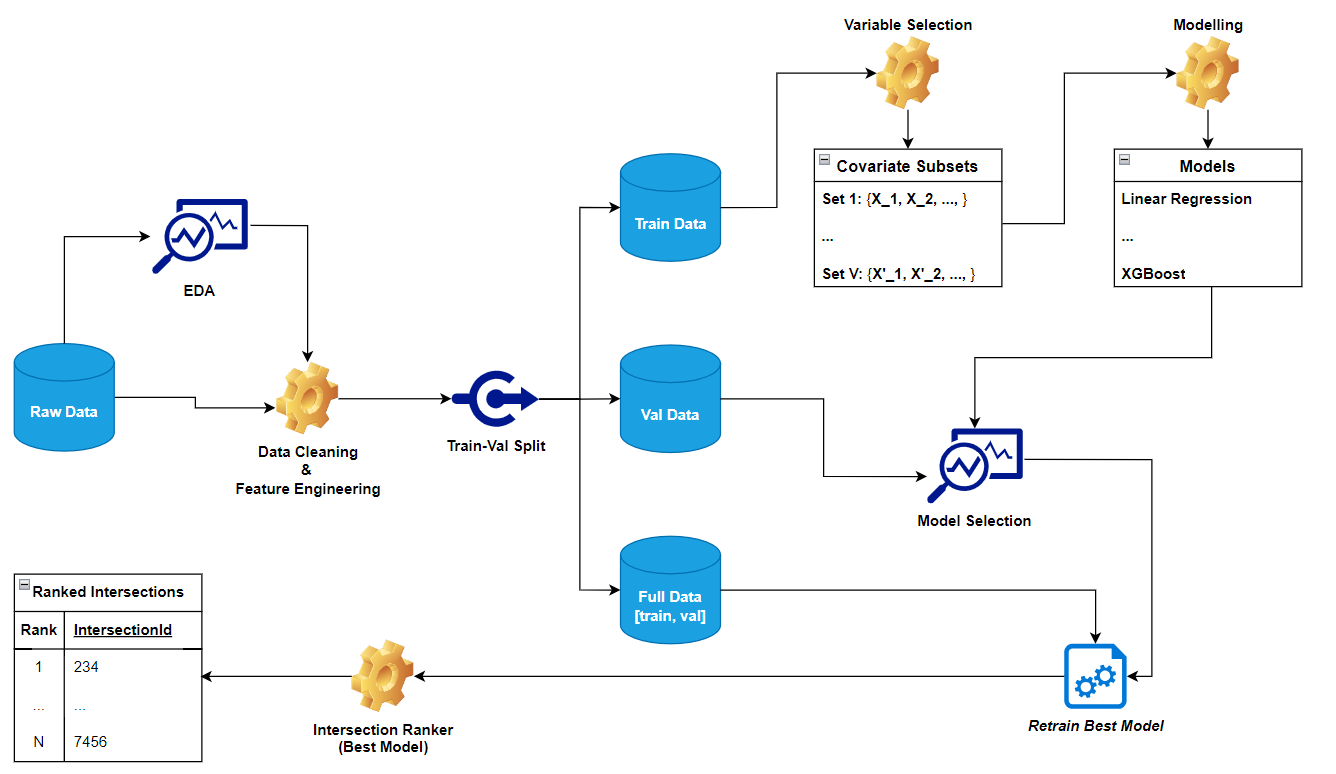

Road Safety Pilot - Data Science

Modeling of accidents observed in the last 10 years to provide the city of Montreal with a ranking of the 1864 intersections in terms of safety (from the most dangerous to the least dangerous), so that it can prioritize the riskiest intersections with the aim of improving infrastructure.

CV Parser

An NLP information extraction application for curriculum vitaes.

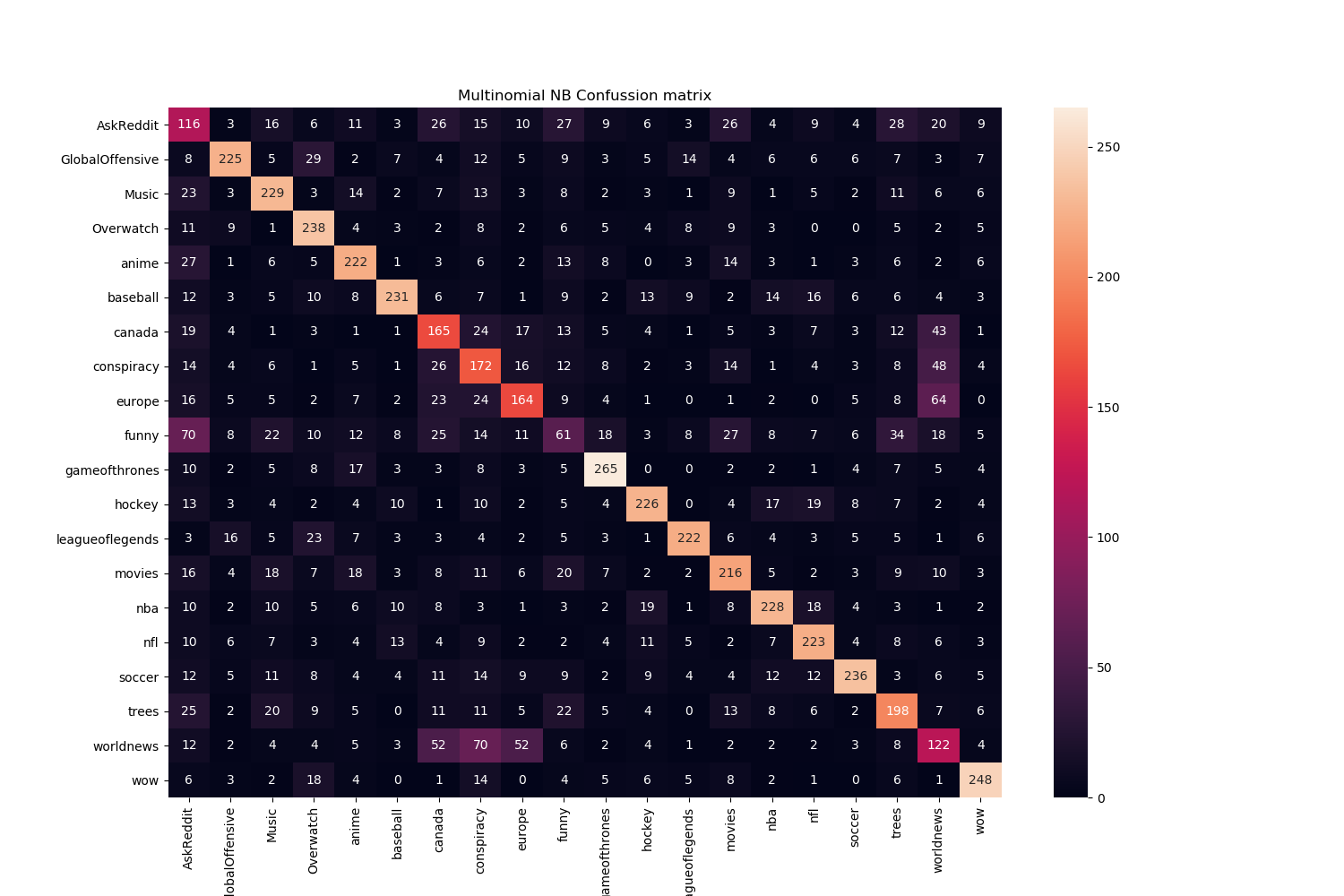

Multiclass Text Classification

Reddit dataset multi-class text classification challenge using integrated NLP analysis and traditional machine learning pipelines using Python libraries such as nltk and sklearn.

Neural Style Transfer

A couple of images I produced using the famous neural style transfer with different style images.

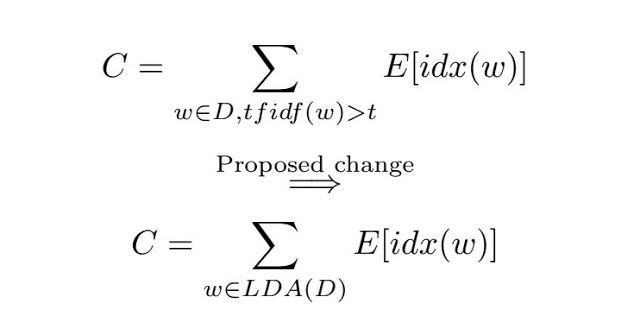

Automatic Text Summarization

Improved automatic text summarization using centroid embeddings combined with Latent Dirichlet Analysis (LDA) as an improvement to the algorithm described in the original paper.

Fintech Projects

Financial Engineering

QuantGold Dashboard

Advanced Canadian ETF Portfolio Management Dashboard incorporating daily static snapshots, Monte Carlo simulation, interactive macro indicators, quantitative risk and portfolio management.

FinReportRAG

An AI-native financial analytics system engineered with a modular microservices approach, integrating FastAPI for high-throughput API orchestration, LangChain for dynamic LLM-driven reasoning, OpenAI's transformer-based models for contextual comprehension, and a high-dimensional vector database for optimized semantic retrieval, as well as agentic AI.

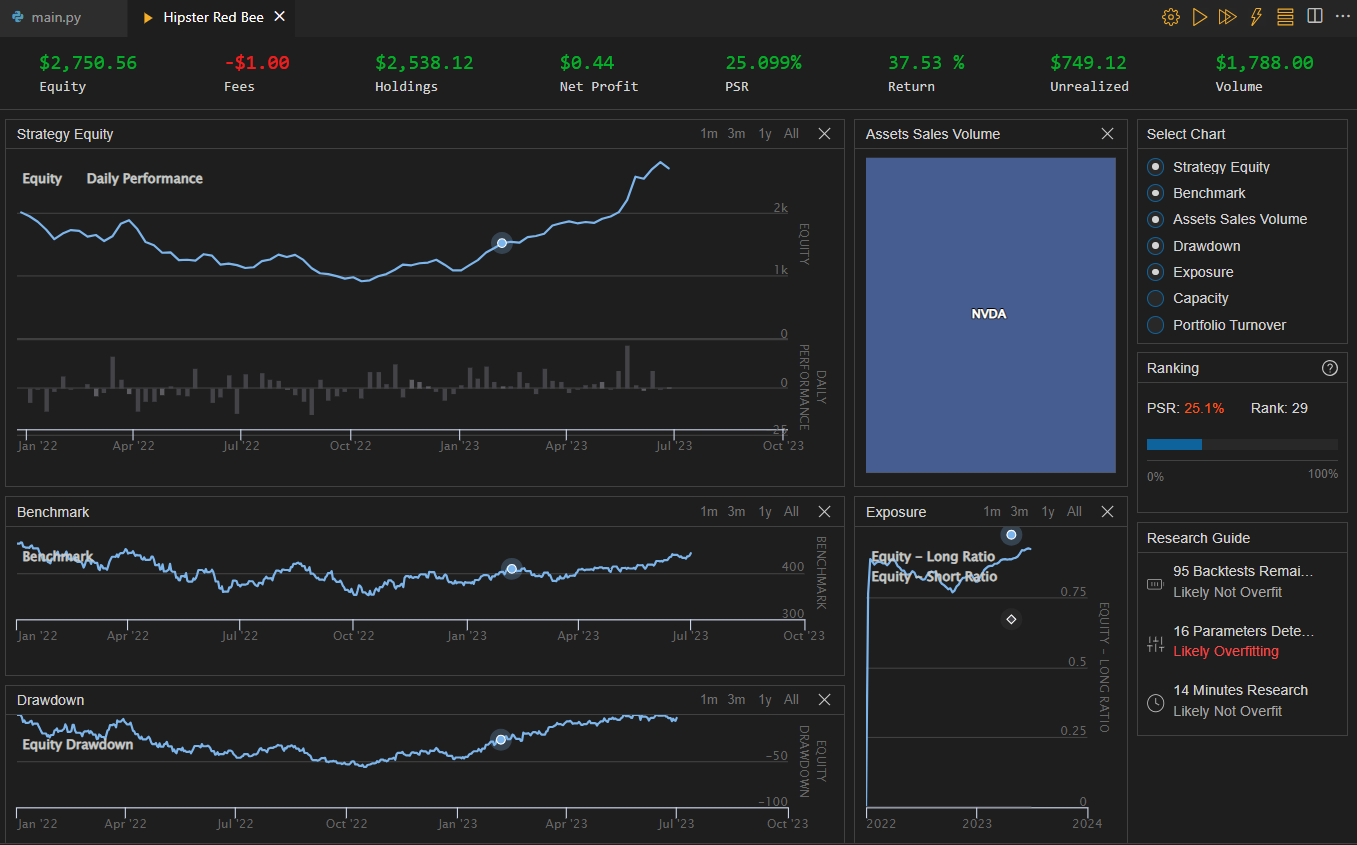

Algorithmic Trading

A number of algorithmic trading strategies employing advanced statistical and machine-learning techniques for Equity and Options trading. Development of these strategies tested on QuantConnect.

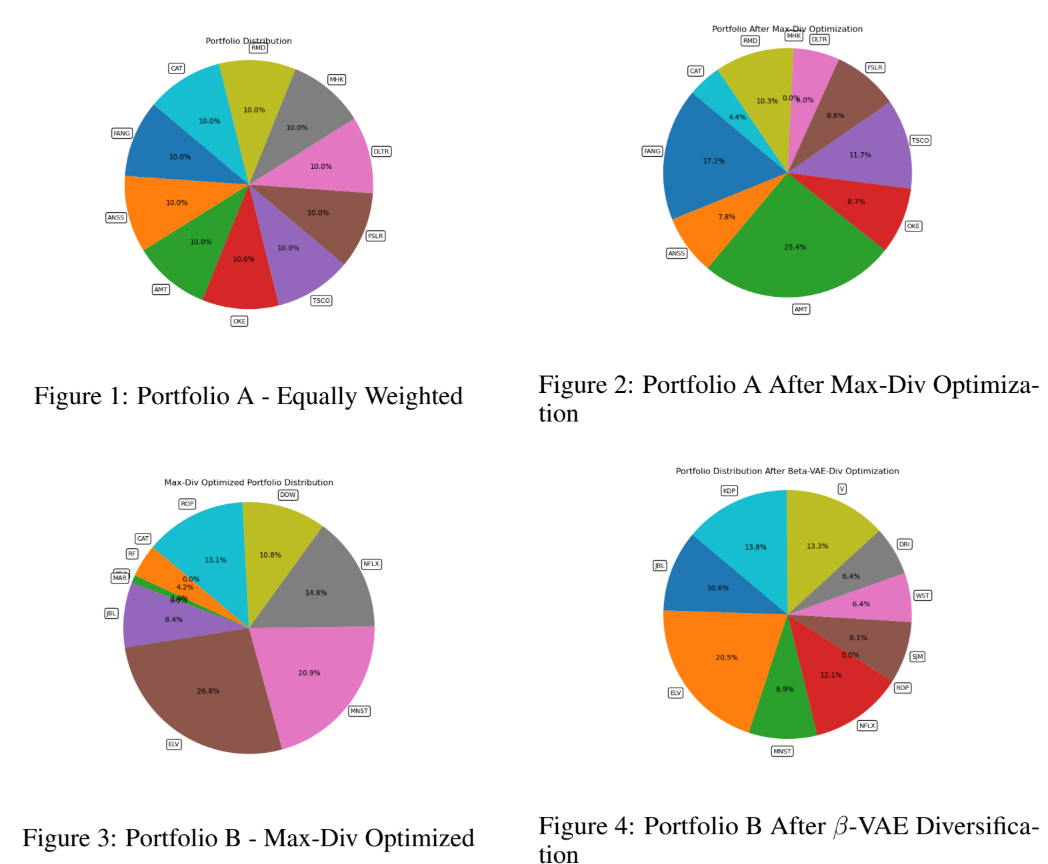

StockDiversifier

An innovative portfolio diversification algorithm using financial engineering and Beta-VAE stock embeddings.

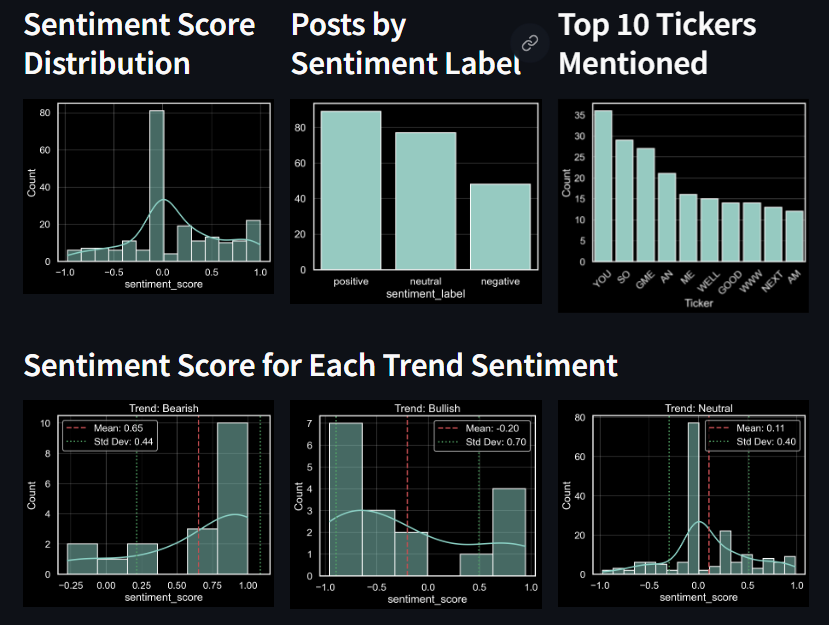

WallstreetbetsGen NLP

AI-powered behavioral analysis framework of Wallstreetbets investor discussions using topic clustering, sentiment analysis, text mining, and data analytics with Python, HuggingFace, Streamlit, and Google Cloud.

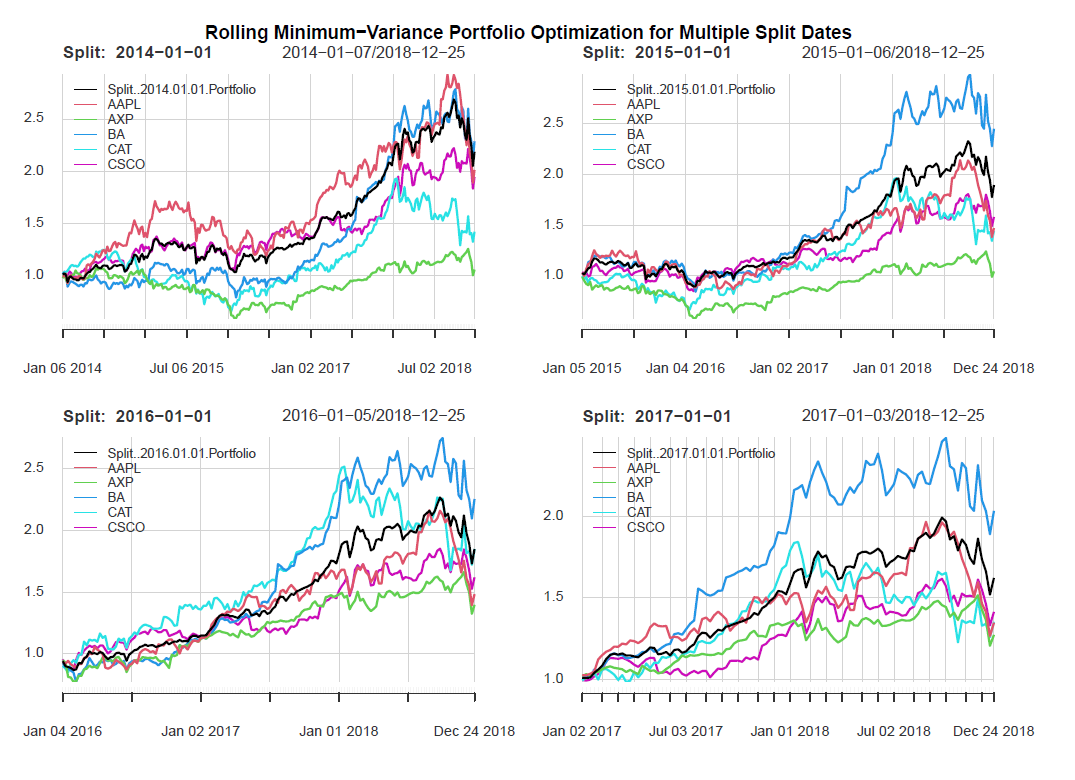

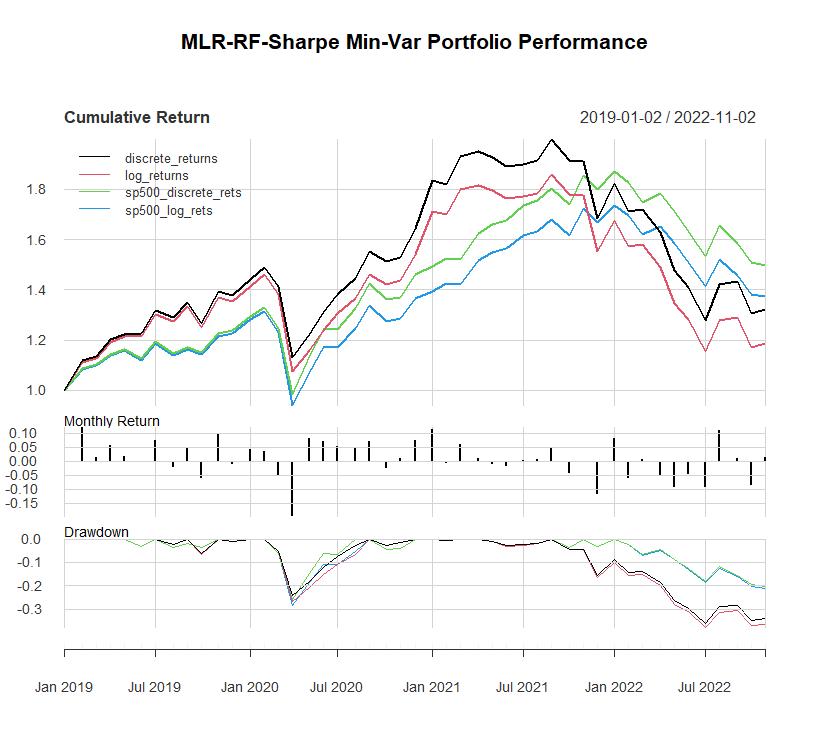

Portfolio Optimization

Minimum-variance portfolio optimization with rolling window in R.

Algorithmic Portfolio Management

Algorithmic momentum-replication strategy based on the SP500 leveraging advanced statistical techniques and machine learning methods. With the help of a mix between technical and traditional portfolio optimization techniques, we achieve backtesting performance comparable to the SP500.

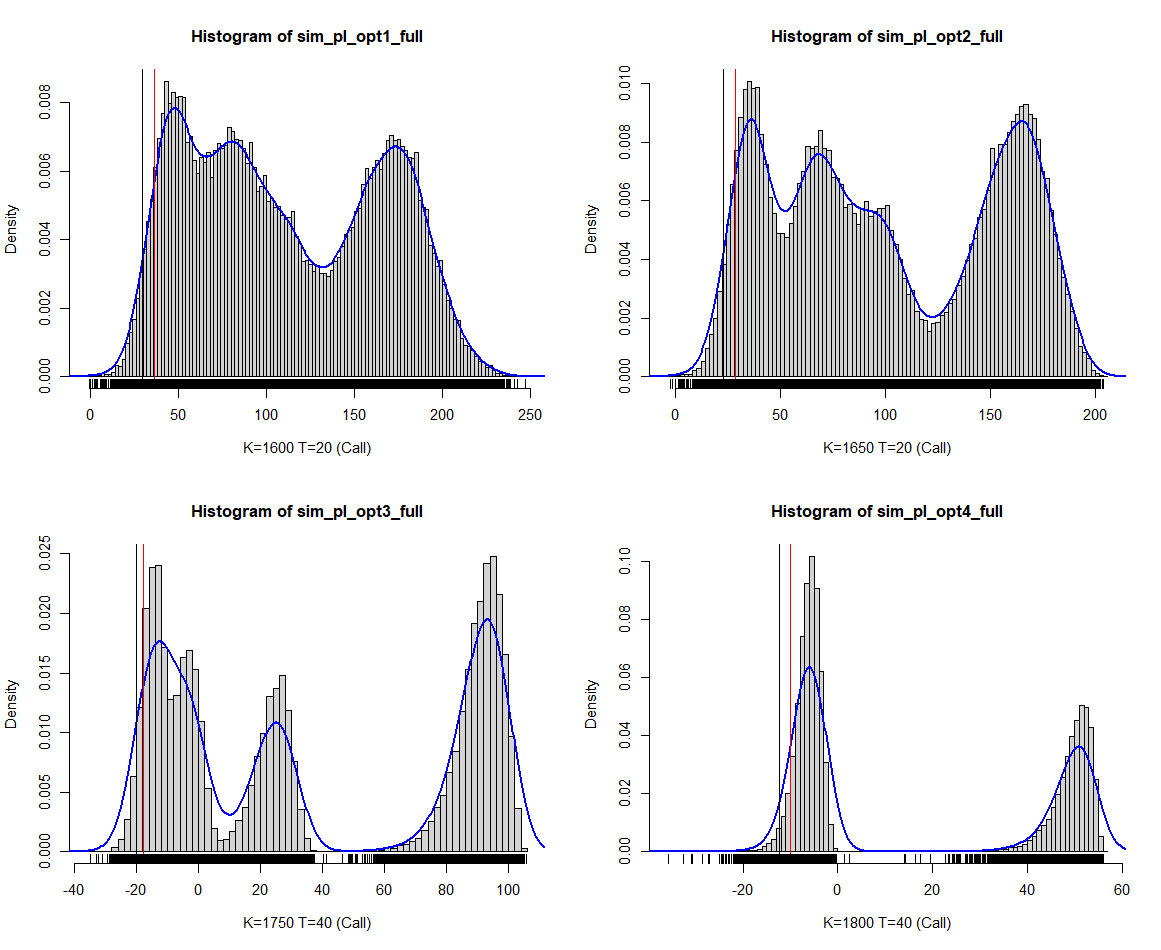

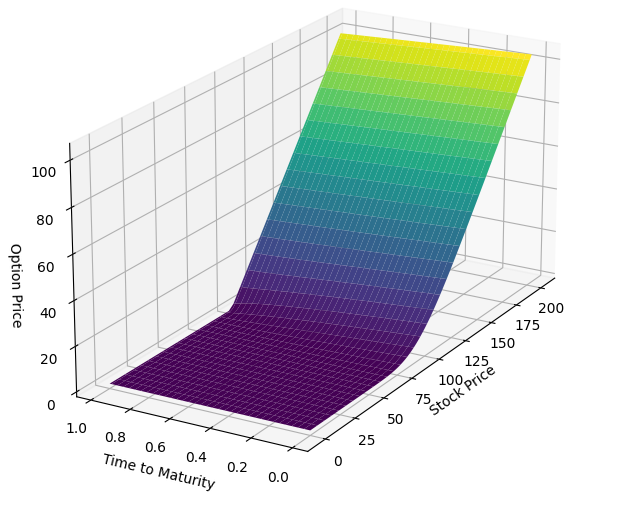

Risk Management: European Options on SP500

Risk management framework for estimating the risk of a book of European call options on the SP500 by taking into account risk drivers such as underlying and implied volatility. A rigorous theoretical and applied approach is employed with R, RStudio, and Git/Github.

Miscellaneous Projects

Software Engineering

Catplotlib

A simple wrapper for Python Matplotlib library... with cats.

Dating Rental Database Project

Initially as a final project for my database systems class, I created a full database application using PostgreSQL and Python from scratch, including design, schema, and a friendly user interface.

Responsive Dynamic Portfolio

After having taken half a Web Developing course on Udemy, and googling every 2 seconds, I learned a couple of things. The page you are navigating right now is the result of that effort :).

Technical Writing

Medium Articles

Understanding the BLEU and ROUGE Metrics for LLMs

By using GPT-4, ScholarAI, and SmartSlides

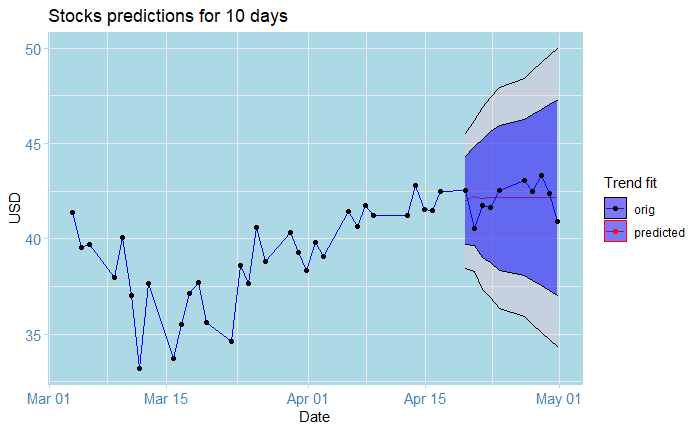

Time Series Analysis Stock Forecasting

Why is it so hard to predict stocks? In this article, I present a complete forecasting pipeline using ARIMA model in R, including data preprocessing and engineering.

A Complete Introduction to the Black-Scholes Model

A Mathematical Perspective with Stochastic Calculus and Python

Functional Programming in Python

What is functional programming? What are the advantages and disadvantages? How do we implement it in Python? Check it out!

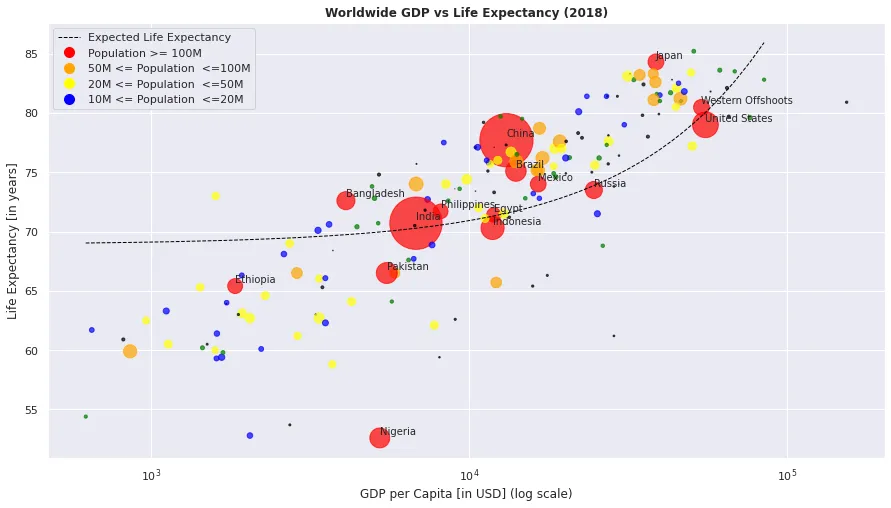

A Quick Guide to Beautiful Scatter Plots in Python

Visualizing worldwide Life Expectancy vs GDP per capita

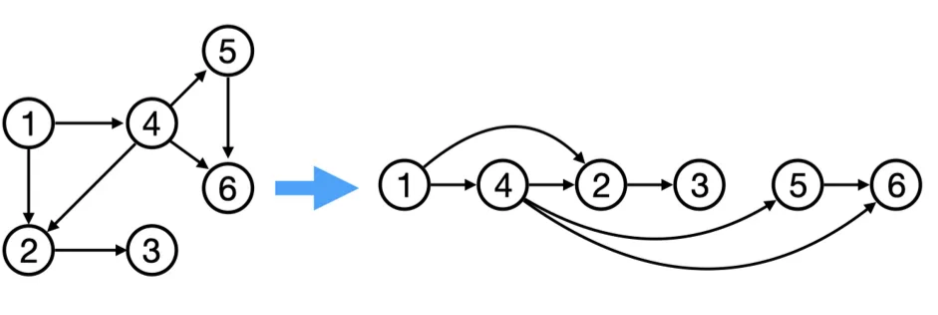

Comparing Topological Sort Implementations

With examples in Java and Python